403b Max 2025. In 2025, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their. In 2025, the combined limit for employer contributions and employee elective salary deferrals is $69,000.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.

403(b) Contribution Limits for 2025, The 403b contribution limits for 2025 are: For 2025, this limitation is increased to $53,000, up from $50,000.

403(b) Contribution Limits For 2025 And 2025, In 2025, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their. 403 (b) contribution limits consist of two parts:

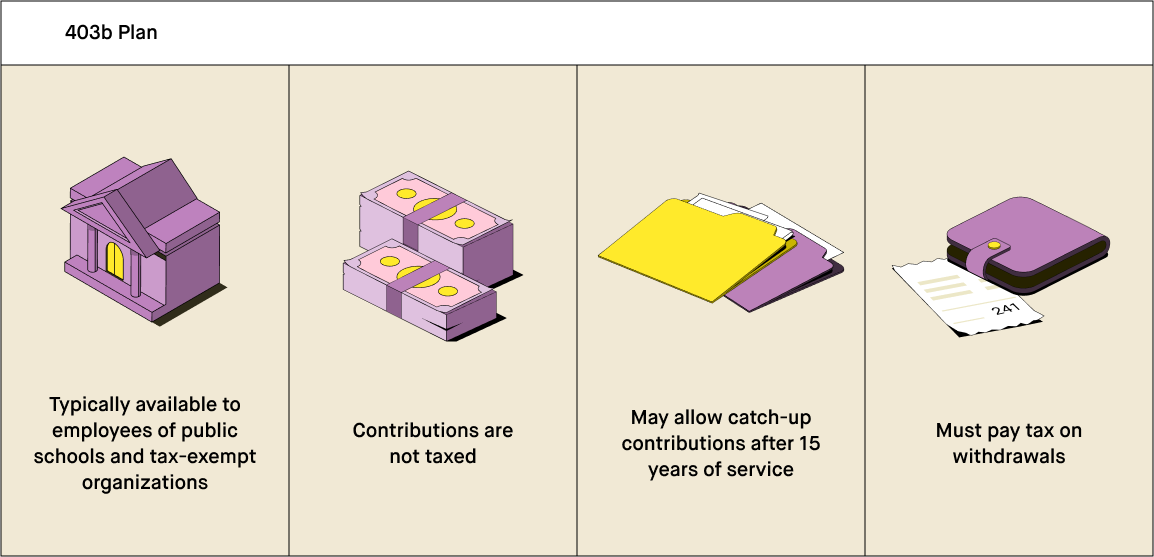

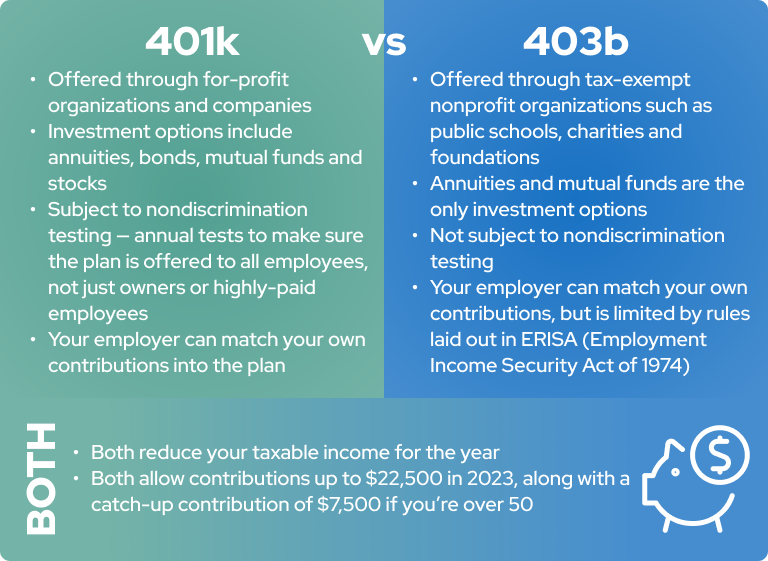

A Comprehensive Guide To A 403b vs. 401k (2025), The internal revenue service recently announced the annual 403 (b) limits for 2025. 403 (b) contribution limits consist of two parts:

The Benefits of a 403(b) Retirement Plan SDG Accountants, For 2025, the 403(b) max contribution limit is $22,500 for pretax and roth ira contributions. Your total combined employee and employer match contribution limit.

What is a 403b Plan? Robinhood, The total number of winners in this draw was 573,539. However, the amount contributed can’t exceed 100% of an.

403(b) Plans The Basics Austin Asset, The total number of winners in this draw was 573,539. This compares to 492,619 in the previous lotto max draw on 19th march, which represents a 16.4%.

Roth IRA vs. 403b Which is Better? (2025), Like 401 (k) plans, 403 (b) plans allow participants to set aside money for. In this publication, you will find information to help.

How Does a 403(b) Plan Work?, This means that for savers under 50, you can defer $23,000 per year, or a total combined $69,000. In 2025, you can contribute up to $23,000 to a 403 (b).

.jpg)

403(b) Retirement Plans TaxSheltered Annuity Plans, The 403b contribution limits for 2025 are: The limit on annual additions (the combination of all employer contributions and employee elective salary deferrals to all 403 (b) accounts) generally is the lesser of:.

401k vs 403b Know the Differences YouTube, The 2025 403 (b) maximum contribution limit for 2025 is $22,500 for employees contributing to a traditional 403 (b). If you are under age 50, the annual contribution limit is $23,000.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025.